Handling the probate process for the Earnhardt estate requires precision to avoid costly errors. Focus on these common pitfalls to streamline proceedings.

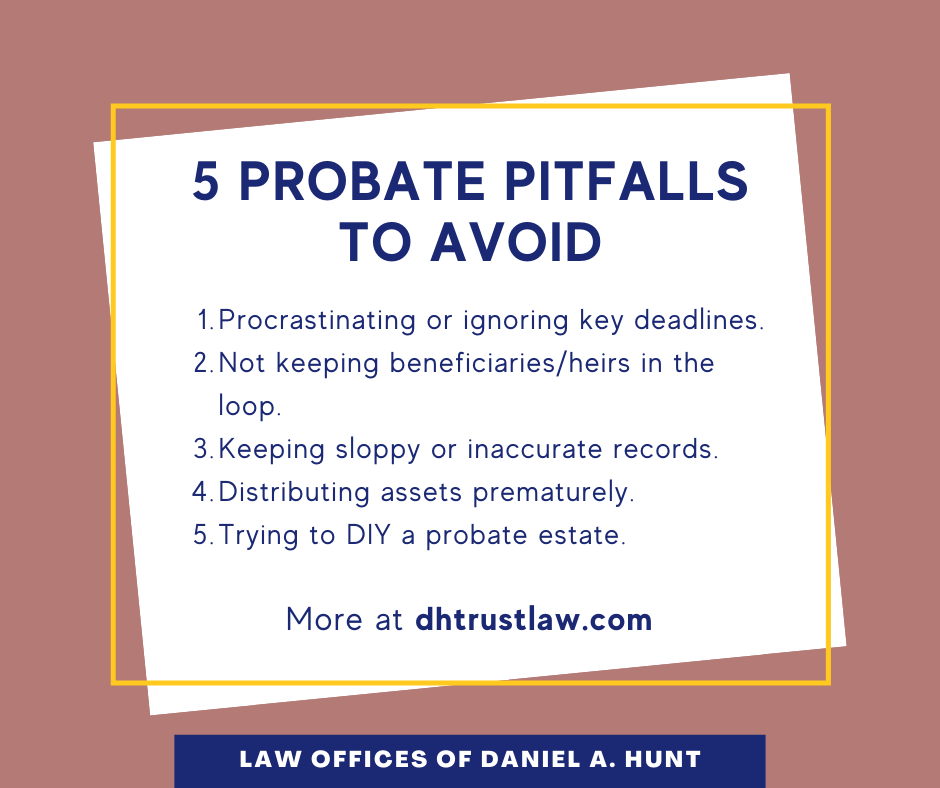

Key Mistakes to Avoid

- Incomplete documentation: Failing to file the will or asset lists promptly can cause delays; ensure all paperwork is organized and submitted early.

- Overlooking creditor claims: Ignoring debts may lead to disputes; notify creditors officially and address liabilities before distributing assets.

- Family conflicts: Unresolved disagreements among heirs often prolong probate; involve a neutral mediator to facilitate discussions.

- Improper asset valuation: Underestimating estate value triggers tax issues; hire a professional appraiser for accurate assessments.

- DIY legal processes: Skipping professional advice risks errors; always consult an estate attorney to navigate complex laws.

Strategies for Saving Time and Money

Implement these tactics to expedite probate efficiently. Start by consolidating assets and communicating clearly with beneficiaries to prevent misunderstandings.

- Pre-probate planning: Use trusts or joint ownership to minimize assets subject to probate, reducing time and fees.

- Timely filings: Meet all court deadlines strictly to avoid penalties and unnecessary adjournments.

- Cost-effective professionals: Hire specialized advisors like CPAs for taxes, focusing on fixed-fee arrangements to control expenses.

- Digital record-keeping: Maintain digital backups of documents for quick access, streamlining verifications and reducing manual handling.

Proactive measures and expert support ensure a smooth probate journey, preserving the estate's value and honoring legacy goals.