Polymarket's NBA MVP prediction market allows users to trade shares based on who they believe will win the NBA's Most Valuable Player award for a given season. Prices represent the perceived probability of each outcome.

Current Market Mechanics

Users buy "Yes" shares if they believe a player will win (priced between 1¢ and 99¢, representing 1%-99% probability). "No" shares are available if they believe the player won't win.

- If the player wins, "Yes" shares settle at $1.00 each; "No" shares become worthless.

- If the player loses, "Yes" shares become worthless; "No" shares settle at $1.00 each.

Key Factors Influencing MVP Odds

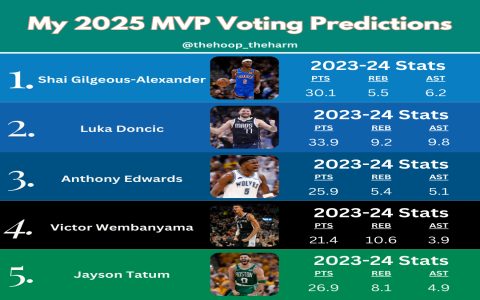

- Individual Statistics: Points, rebounds, assists, efficiency metrics, and advanced analytics dominate voter perception.

- Team Success: MVP winners almost always come from teams with top conference records.

- Narrative & Media Attention: Compelling storylines (e.g., bounce-back seasons, historic performances) significantly impact betting sentiment.

- Player Availability: Significant missed games due to injury dramatically reduces chances.

- Voter Fatigue: Recent winners face higher thresholds to win again consecutively.

Notable Contenders (Subject to Market Fluctuations)

- Established Superstars: Players like Nikola Jokic, Giannis Antetokounmpo, Luka Doncic, and Joel Embiid typically start seasons with high probability percentages.

- Emerging Stars: Young talents demonstrating elite impact on winning teams see their odds surge (e.g., Shai Gilgeous-Alexander).

- Impactful New Situations: Stars joining new teams or experiencing major roster shifts around them can shift probabilities quickly.

Strategic Considerations for Traders

- Monitor News Relentlessly: Injuries, team performance shifts, and major storylines cause rapid price movements.

- Understand Historical Precedents: Voters favor elite stats + top seeds; outliers are rare.

- Assess Value vs. Probability: Identify instances where the market price seems misaligned with the underlying probability based on analytics or narratives.

- Manage Risk: Prices can be volatile; unexpected events occur frequently.